Rebuild Your Credit, Regain Control

Free DIY-friendly tools Intended to help you boost your score and take back your financial freedom.

Three Options. Endless Possibilities.

Free DIY Plan — $0

Start completely free.

No subscriptions, no payments.

Access to the Sold and Stay DIY credit repair portal

Guided instructions for building dispute letters by hand

Downloadable letter templates (late payments, charge-offs, inquiries, collections, etc.)

Ability to print and mail letters yourself (no automation)

Progress tracking for your disputes

Educational guides on credit scoring, bureaus, and your rights under the FCRA

Learn the same process professionals use — without the price tag

Upgrade anytime to unlock automation and credit report integration

Best for self-starters who are comfortable following step-by-step instructions and managing their own disputes manually.

Premium DIY Plan — $21.99

Unlock AI automation.

Get live credit data.

Full access to the Sold and Stay credit repair portal

Automatically generates dispute letters with your details pre-filled

Secure access to your full 3-bureau credit report

Monthly updates from Experian, Equifax, and TransUnion

Real-time credit score tracking and monitoring alerts

Smart automation to guide you through each dispute step

Reduce time and errors with personalized workflows

Cancel anytime — no contract, no pressure

No markups or commissions — we earn nothing from this

Best for people who want a smoother, more guided process with access to their full credit profile.

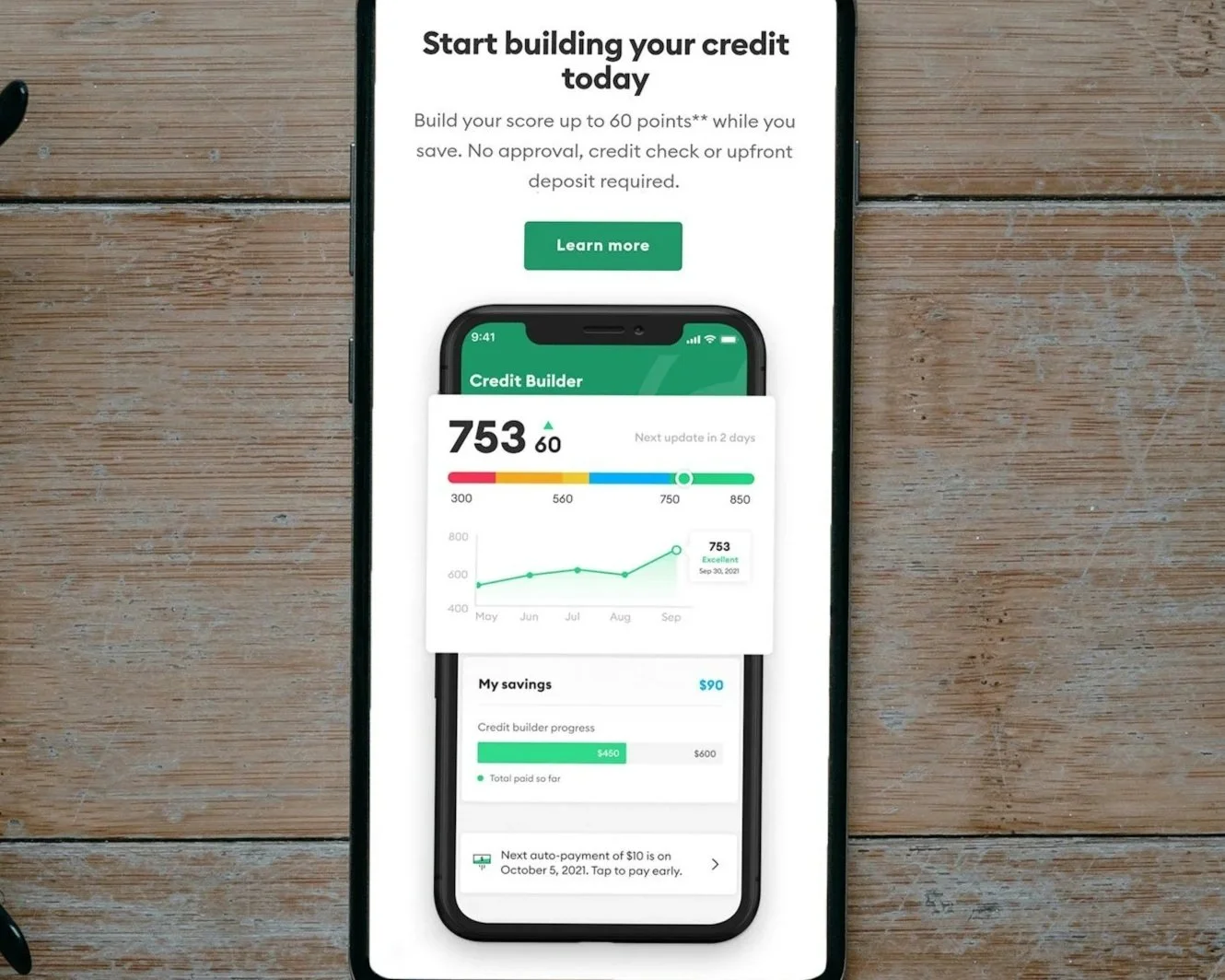

Credit Builder Card®

A simple, secure credit-building tool.

No hard credit check.

Build or rebuild credit with a small refundable security deposit. Your deposit becomes your spending limit for full control

Reported to the three major credit bureaus

Straightforward design with no confusing fee traps

Use for small purchases and pay on time to build positive history

Approval is based on issuer criteria and never guaranteed. The entire process handled securely through Credit Builder Card®

Sold & Stay is not a lender and never sees your application

We may earn a referral fee, but your terms never change

Best for people who want a simple, DIY-friendly way to begin rebuilding credit with consistent habits and structure. If you’re using a VPN, you must disable it to access the link.

Why We Offer

These Tools

At Sold & Stay, we often have conversations with people who are navigating financial transitions. Some are exploring a home sale. Some are rebuilding after a setback. Others are preparing for their next chapter with more stability and confidence.

Stronger credit gives you more options in all of those situations. That may include opportunities we can help with in the future, or it may simply give you more freedom and flexibility in your own financial life. Either way, you are welcome here.

These DIY credit tools are designed to support you at your own pace. That includes the Credit Builder Card® option for people who want a simple, secure way to start rebuilding credit with responsible use. You can use these tools for any purpose that matters to you, whether you are preparing for financing, considering a refinance, or working toward a more stable foundation.

If you sign up for any of our DIY resources, we collect your contact information so we can check in later and see how you are doing. If there is a moment when we can offer support beyond credit building, we will be here as a resource whenever you are ready.

This is simply our way of giving back. Better credit leads to better choices, better outcomes, and better opportunities for your future, no matter which path you take.

DIY Credit Repair

Frequently Asked Questions

-

Yes — the tools in the portal are free to use. If you choose the Free DIY Plan, you can create and send dispute letters manually with no cost at all. The Premium DIY Plan is $21.99/month and gives you live credit data and automation — but we earn nothing from it.

-

To automate the dispute process and track your score, the system needs your full 3-bureau credit report. That $21.99/month fee goes directly to the secure credit report provider — we’ve waived our commission to get you the lowest possible price.

-

Absolutely. Many people start with the Free plan to learn the process, then upgrade later for convenience and real-time tracking. You can switch anytime.

-

No. Using your own credit report, sending dispute letters, and monitoring changes will not negatively affect your score. These are tools to help you take back control — not harm your credit.

-

No. Everything you do in the credit repair portal is private and secure. We don’t see your report, account activity, or dispute history. This is a self-directed system built for your privacy.

-

Because we believe better credit leads to better options — in housing, finance, and life. Whether or not we ever work together, we want to give you tools that move you forward. This is our way of giving back.

We do earn a small commission any time someone signs up for the credit builder card, but this does not affect your terms and you are never required to use our link. -

No. This is a self-guided tool designed to help you understand and improve your credit on your own. It’s not a substitute for financial planning, legal advice, or professional counseling — but it can be a powerful first step toward getting organized and moving forward.

-

Yes — everything provided follows your rights under the Fair Credit Reporting Act (FCRA). You have the legal right to dispute inaccurate or outdated information on your credit report. This platform simply gives you the tools to do it effectively and safely.

-

Yes — you’re always welcome to reach out. While we don’t provide credit repair services ourselves or offer financial advice, we’re happy to point you in the right direction and answer questions about how the platform works. And if you think you might need help with a real estate solution down the line, we’d love to explore that with you when the time is right.

What You’ll Gain

Clarity

Understand what’s on your credit report and how it’s affecting your score.

Control

Take action on your own terms. No sales reps or pressure.

Confidence

Know your rights and use proven dispute tools to correct inaccurate data.

Convenience

Choose between hands-on or automated tools. Upgrade only if you want to.

Affordability

Start completely free, or access premium tools for just $21.99/month. (We make $0 from these DIY Credit Repair tools — it’s all for your benefit.)

Freedom & Momentum

A better credit profile gives you more flexibility for your future, whether it’s with us or not. Even small progress can unlock new possibilities. and this gives you a way to start, today.

CREDIT BUILDER CARD®

Frequently Asked Questions

-

Any requests for clarification or help should be sent to support@creditbuildercard.com

-

No. Signing up for DIY tools or exploring Credit Builder Card® does not create an obligation to work with us. These resources are available for anyone who wants them. If we reach out later, it is only to check in and see how you are doing.

-

No. A secured credit card cannot stop foreclosure or change any legal timelines. It is only a credit building resource. If you are facing a foreclosure timeline, we always recommend speaking with a local attorney or a HUD approved housing counselor at hud.gov.

-

No. Credit Builder Card® is not a credit repair service and Sold & Stay does not offer credit repair. This is a self-guided tool that supports responsible credit habits. Any changes to your credit depend on your own financial behavior and other information in your credit report.

-

Yes, you get the deposit back when you close the account so long as the account is paid in full at the time of closure.

-

Credit Builder Card® is a secured credit card marketplace. Based on the state you live in, they match you with a secured credit card that has a low $200 security deposit and reports to all 3 credit bureaus. Their mission is to help our users build credit and reach their financial goals while avoiding credit cards that charge interest rates over 30%, high annual fees and application fees.

Credit Builder Card® uses a small refundable security deposit as your spending limit. You make small purchases, pay them off on time, and the card issuer reports your activity to the credit bureaus. Responsible use may help build or rebuild your credit profile over time, although results vary for every person. -

As of now, yes! The issuer wants the card to be accessible to everyone and that means no hard credit inquiry when you apply and no credit score requirement for approval. You use your own money to fund your deposit to open your secured credit card and as a result, there are no strict credit requirements. You may not be approved for a secured credit card if you have an active bankruptcy. In select situations, the issuing Bank may request a copy of your Drivers License and a utility bill or bank statement to verify your identity.

However, we cannot guarantee that this will always be the case. Credit Builder Card® uses its own approval process that is subject to change without notice. That may include a credit inquiry, depending on the card issuer and your state. Any inquiry is handled entirely by the issuer and will be clearly disclosed before you submit your application. Sold & Stay does not access your credit report, cannot see your information, and is not involved in the approval process. -

The Credit Builder Card is designed to help you build your credit with all three credit bureaus. It would be impossible to say how much your score will go up but the issuer reports that some members have seen their credit score improve by more than 50 points. Please note that each individual has a unique credit report and we cannot make any guarantees as to your specific score improvement. To get the maximum increase for your credit score, we recommend speaking with a financial advisor. The general rule of thumb is to always make your payments on time and never spend more than 30% of your card limit each month.

-

No. When you use our partner link, you go directly to the official Credit Builder Card® website. We cannot see your application details, your credit report, or any activity on your account.

-

Valid question, and one that should be asked of any business these days. We may receive a referral fee if you open an account through our partner link. Your terms do not change and there is no obligation to move forward.

The fine print

Sold and Stay LLC is not a credit repair organization as defined under federal or state law and does not provide credit repair services, legal advice, financial counseling, or representation. We do not access your credit reports, dispute information on your behalf, or interact with creditors or credit bureaus for you. Any credit repair or credit-building tools featured on this site, including dispute platforms and the Credit Builder Card® option, are provided through independent third-party companies. Each third party sets its own terms, pricing, approval criteria, and data practices. Accessing certain tools may require a paid subscription to a credit reporting service or may involve a refundable security deposit, depending on the product you choose. Sold and Stay LLC does not control these products, does not influence approval decisions, and does not guarantee any outcome related to your credit. We may receive a referral fee if you use our Credit Builder Card® partner link, but we receive no commission or compensation for your use of the DIY credit dispute platform. Any decisions you make regarding your credit, finances, or legal situation are solely your responsibility. We encourage you to consult with a qualified attorney, credit counselor, or financial advisor for advice tailored to your specific needs.

Take action

DIY Credit Repair

It only takes 60 seconds. Create your free account and get instant access to your dashboard.

(Choose Free or Premium after sign-up, $21.99/month if you upgrade — we earn nothing, and you can cancel anytime.)

Credit Builder Card®

A simple and secure way to start rebuilding your credit with a small refundable deposit. Apply in minutes. VPNs must be disabled to access the link.

(Approval is never guaranteed. Terms are set by the issuer. We may earn a referral fee, but your terms stay the same.)